The Social Security program is expected to run short of cash to pay promised benefits in about ten years, while a key trust fund for Medicare will run out of funds by 2031, according to new forecasts issued Friday by trustees of both programs.

The projections serve as an annual reminder that the popular programs rest on shaky financial footings. While any effort to patch them is sure to face stiff political opposition, doing nothing is likely to be worse.

Social Security benefits for retirees and others are primarily paid for through payroll taxes on current workers, and are supplemented by a trust fund.

Benefits paid out by the program have exceeded money coming in since 2021, and the trust fund is now expected to be depleted by 2033. That's a year earlier than forecast last year, thanks in part to slower economic growth.

Unless changes are made before then to shore up the program, 66 million Social Security recipients would see their benefits cut by 23-25%.

Meanwhile, the Medicare trust fund, which supplements payments to hospitals and nursing homes, is also running out of cash. That could result in an 11% pay cut to health care providers unless changes are made by 2031. That deadline is three years later than had been forecast last year.

Trustees anticipate some cost savings for Medicare, thanks to a switch to less-expensive outpatient treatments and because some people who would have required the most costly care died prematurely during the pandemic.

Millions depend on Social Security, Medicare

Treasury Secretary Janet Yellen, who leads the trustees, stressed the importance of propping up both trust funds to avoid draconian cuts in benefits and provider payments.

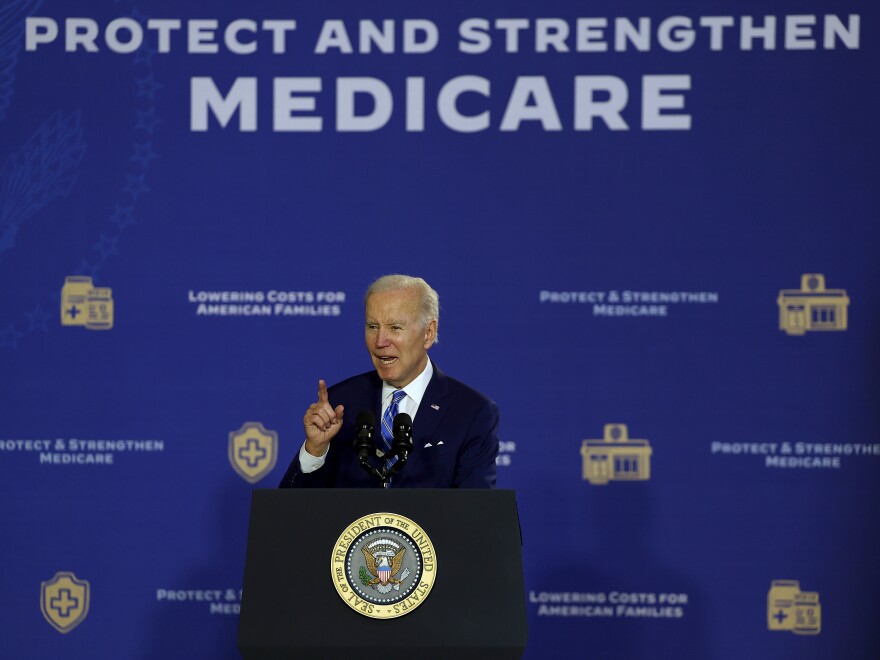

"Social Security and Medicare are two bedrock programs that older Americans rely upon for their retirement security," Yellen said in a statement. "The Biden-Harris Administration is committed to ensuring the long-term viability of these critical programs so that retirees can receive the hard-earned benefits they're owed."

As part of its budget, the Biden administration proposed extending the life of the Medicare trust fund by 25 years, largely through higher taxes on wealthy individuals. The administration has not proposed similar fixes for Social Security.

The primary challenge for Social Security is demographic. As aging baby boomers retire, there are fewer workers paying into the program to support the rising cost of benefits. As of last year, there were just 2.7 workers paying into the system for each person drawing Social Security benefits.

Additionally, a smaller fraction of income is now subject to the payroll taxes that support Social Security.

Patching the program will require higher taxes, lower benefits or some combination of the two.

"The only responsible thing to do is admit that we've got to make changes and we disagree about how to do it but let's sit down and try to figure those out," said Maya Macguineas, president of the Committee for a Responsible Federal Budget. "If we wait until the last minute, they'll be much, much harder."

Copyright 2023 NPR. To see more, visit https://www.npr.org.