This month, millions of Americans will have to make student loan payments after a three-year pandemic-era pause. But since 2020, there have been some big changes made to the repayment system.

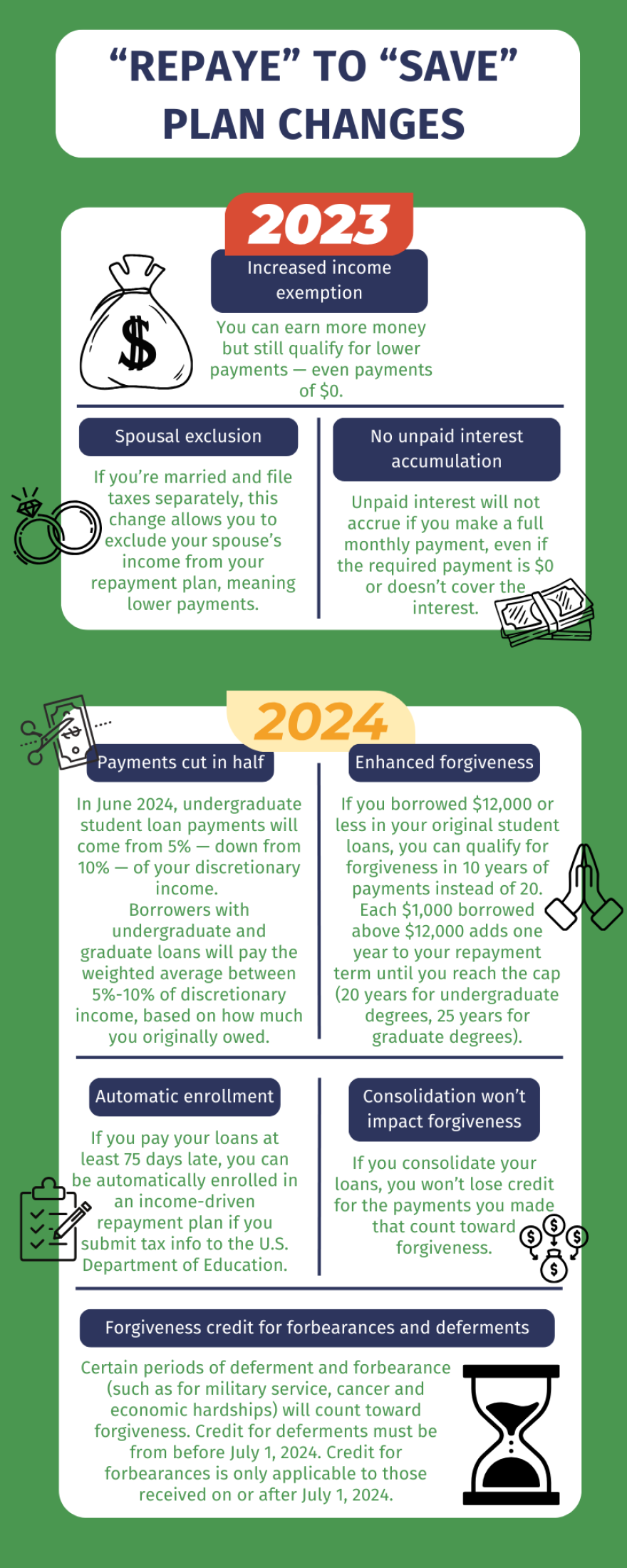

The biggest changes were to the REPAYE income-driven repayment plan, which was rebranded to the SAVE (Saving on a Valuable Education) plan. Some of SAVE’s benefits have gone into effect, while others will start in July 2024. Borrowers enrolled in REPAYE will be automatically enrolled in SAVE.

StateImpact compiled this guide for navigating the new policies of income-driven federal student loan repayment.

Advice from an expert

Brian Walsh leads Advice and Planning at SoFi, a financial service company. He said people's goals for loan repayment generally boil down to two camps: lower payments or faster pay-off.

For people who want to lower their payments, Walsh said there are three common options: income-driven repayment, extending the payment term and refinancing.

For those on an income-driven repayment plan:

“You’ll want to think through how your income is expected to change in the future, and any time you think about that, reality is going to be different than your expectations,” Walsh said. “If your payments are based on a percentage of your income, if you’re expecting to get a promotion next year or maybe get a huge change in your income, that’s going to double your income. That’s fantastic, but your payments would increase significantly as well. So we want people to think through that so, that way, you can actually stick with it as things happen.”

For those who extend their repayment terms:

“When you extend the term of your loan, you’re basically just taking more time to pay it back and spreading your payments out over more periods so your payment will be lower,” Walsh said. “The downside is you’re going to end up paying more interest and more money back over the life of the loan, but it can be a good way to fit it in your budget.”

For those who refinance their student loans:

“You would essentially take out a new loan from a private lender, so you would lose federal benefits, which is a downside,” Walsh said. “But you could potentially lower your interest rate or keep it the same and stretch it out over a longer period of time.”

Walsh said the Biden administration’s new SAVE plan could be a big help for people who want an income-driven repayment plan but need lower monthly payments than the former REPAYE plan. That’s because less of your income counts toward calculating your payment amount.

“With SAVE, they’re excluding more of your income from the calculations,” Walsh said. “And that’s helpful because if you exclude more income, then it’s kind of like you make less money, according to their math — not less money in real life — which means your payments are lower.”

While the new policies settle in, borrowers have some wiggle room to get used to it. The changes include a one-year on-ramp, during which a borrower with partial late or missed payments won’t be reported to credit bureaus or sent to collections. Though, interest is charged throughout this period.

A majority of borrowers did not make payments during the pause, and according to the Consumer Financial Protection Bureau, borrowers have fallen further into debt during the pandemic pause. More than half of student loan borrowers have higher monthly debt expenses than before it began.

Walsh says getting back into the swing of making payments is also made difficult by an economy that’s more expensive to live in than it was three years ago.

“Inflation has been really high, and interest rates have been increasing, making pretty much every other aspect of their lives more expensive,” Walsh said. “So it was really easy for that new room in their budget to get eaten up by just basic day-to-day living expenses, which is why we see a lot of people who did not make those payments.”